Get your first card, secured or unsecuredUsually with a score above 620 you can get an unsecured card

Secured Cards require a deposit that is equal to your credit limitThere is NO Hard Inquiry for a Secured Card

Unsecured Cards do not require a deposit, some do charge an annual feeThere is a Hard Inquiry for a Unsecured Card

To avoid interest charges and possible negative credit score impacts do this

Simply put Netflix or another subscription on your card and set the card for autopay the full balance each month

Store the card in your sock drawer not in your wallet

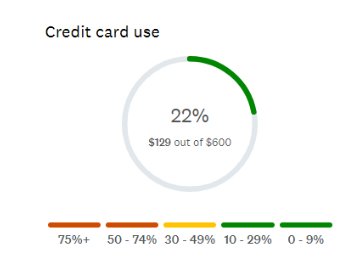

Bingo, you now are getting more points for the credit card use part of the test