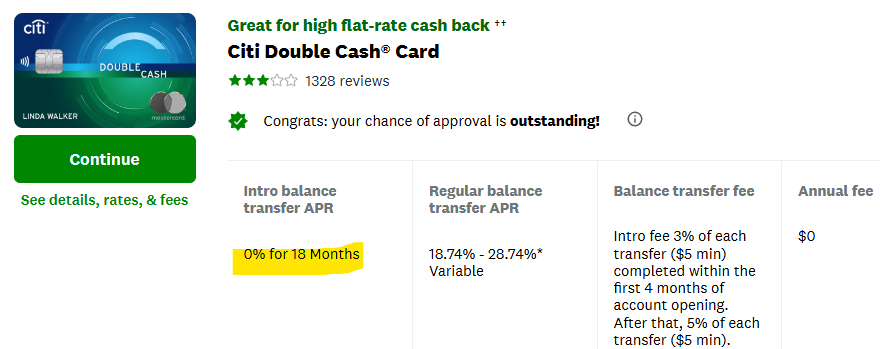

Now that your score is above 700, use the Credit Karma app again and look for a personal loan with a lower rate

The Interest Rate on this second personal loan will be much lower than the rate on the first personal loan

Make sure to look for the seconds personal loan with a different company than the first personal loan

Upon approval, use the money from the second personal loan to pay off the first personal loan

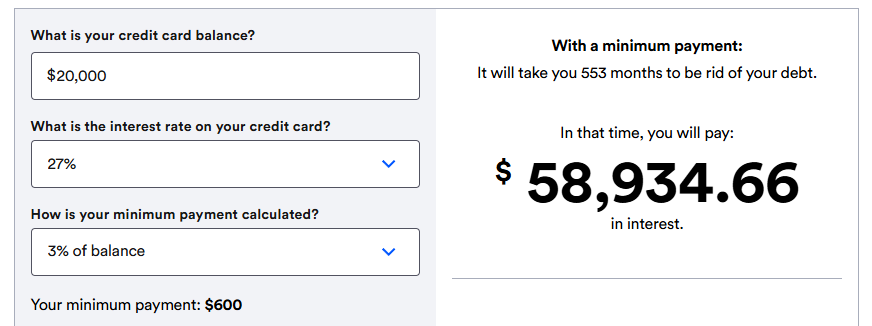

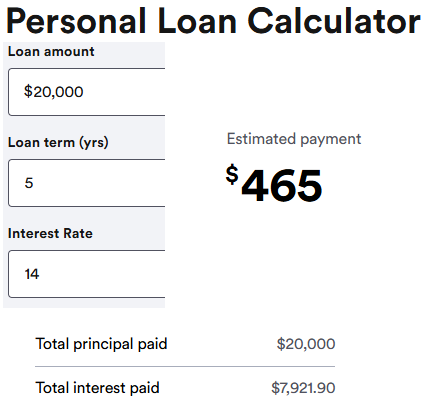

Now your second personal loan will likely be at 14%, and your payment will drop to $465 per month. This will be paid off in 60 months and the total cost will be $27,000 vs $59,000

You can even pay it down faster and pay even less interest